aurora sales tax rate 2021

The Colorado sales tax rate is currently. Interactive Tax Map Unlimited Use.

1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee.

. Method to calculate Arapahoe County sales tax in 2021. 4 Sales tax on food liquor for immediate. The current total local sales tax rate in Aurora CO is 8000.

The Minnesota sales tax rate is currently. Retail Sales 2 Revised August 2021 Colorado imposes a sales tax on retail sales of tangible personal property prepared food and drink and certain services as well as the furnishing of rooms and accommodations. Wholesale sales are not subject to sales tax.

With CD 290 000 010 025 375. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. For residents that work outside of Aurora the city offers a 100 credit up to 2 for those residents who pay local income tax to the city where they are employed.

SalesUseParking Tax Return French Quarter EDD Imposed A New SalesUse Tax Rate at 0245 effective Beginning October 1 2021 Ending June 30 2026 Form 8010 Effective Starting July 1 2019 Present. And Seattle Washingtonare tied for the second highest rate of 1025 percent. Residential Property Tax Rate for Aurora from 2018 to 2021.

Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. What is the sales tax rate in Aurora Colorado. Five other citiesFremont Los Angeles and Oakland California.

The average sales tax rate in Colorado is 6078. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. This is notan all inclusive list.

The minimum combined 2022 sales tax rate for Aurora Colorado is. Search by address zip plus four or use the map to find the rate for a specific location. The following list of Ohio post offices shows the total county and transit authority sales tax rates in most municipalities.

The County sales tax rate is. 2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax.

Did South Dakota v. Austinburg 44010 Ashtabula 675. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. You can print a 825 sales tax table here. Did South Dakota v.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. 44 E Downer Place Aurora IL 60505. This is the total of state county and city sales tax rates.

This Part 1 outlines criteria for determining. The Aurora Sales Tax is collected by the merchant on all qualifying sales. This is the total of state county and city sales tax rates.

The citys Code of Ordinances chapter 187 details the citys income tax policy. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Form 8071 Effective Starting October 1 2021 Present.

The Aurora sales tax rate is. What is the sales tax rate in Aurora Minnesota. For tax rates in other cities see Colorado sales taxes by city and county.

You can print a 85 sales tax table here. You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec.

City of Aurora 250. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. Note that failure to collect the sales tax does not remove the retailers responsibility for payment.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Aurora-RTD 290 100 010 025 375. The December 2020 total local sales tax rate was also 8000.

The County sales tax rate is. Birmingham Alabama at 10 percent rounds out the list of. Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent.

Aurora 44202 Portage 700. Real Estate Transfer Tax Line. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County.

Look up a tax rate. The City of Auroras tax rate is 8850 and is broken down as follows. Ad Lookup Sales Tax Rates For Free.

Footnotes for County and Special District Tax. The Aurora sales tax rate is. Wayfair Inc affect Colorado.

There is no applicable county tax. The average sales tax rate in Colorado is 6078. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

Youll find rates for sales and use tax motor vehicle taxes and lodging tax. Auroras income tax rate is 2 and is based on earned income and business net profits. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

Wayfair Inc affect Minnesota. Method to calculate Austin sales tax in 2021. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax.

The minimum combined 2022 sales tax rate for Aurora Minnesota is. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. POST OFFICE ZIP CODE COUNTY RATE POST OFFICE ZIP CODE COUNTY RATE PAGE 2 REVISED January 1 2021 Dennison 44621.

There is no applicable county tax. Year Municipal Rate Educational Rate Final Tax Rate. 3 Cap of 200 per month on service fee.

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Solving Sales Tax Applications Prealgebra

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

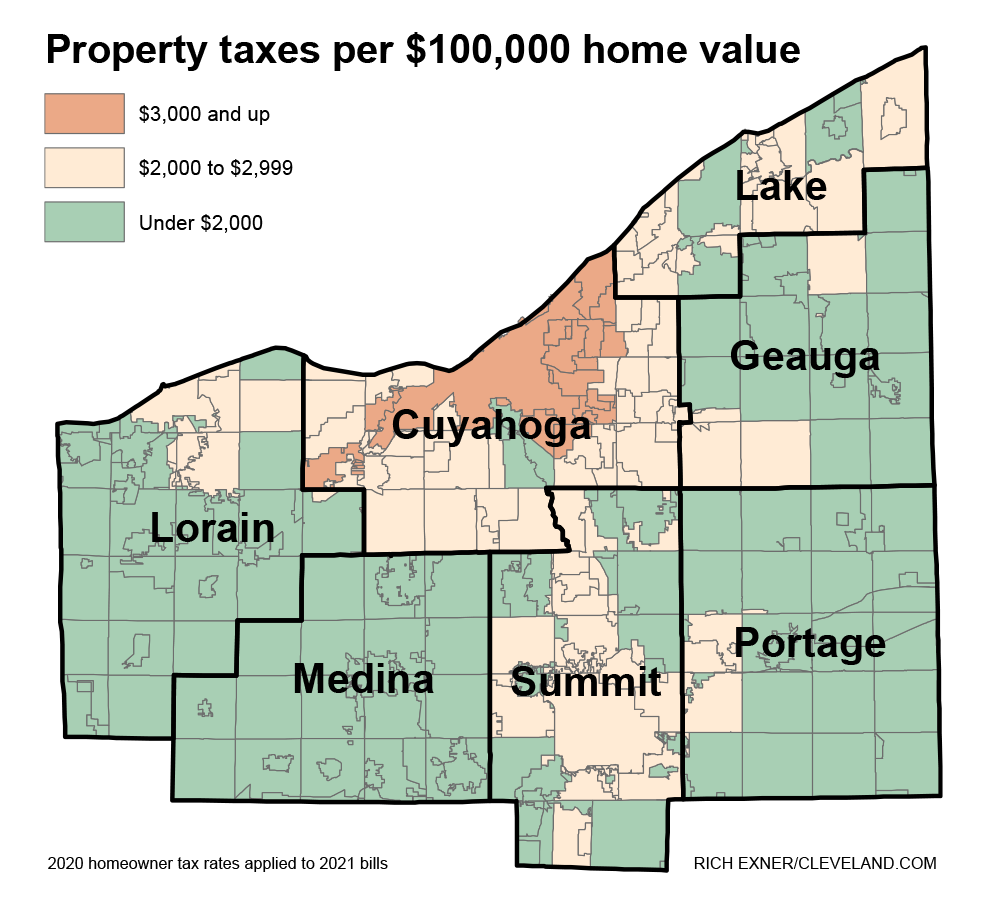

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

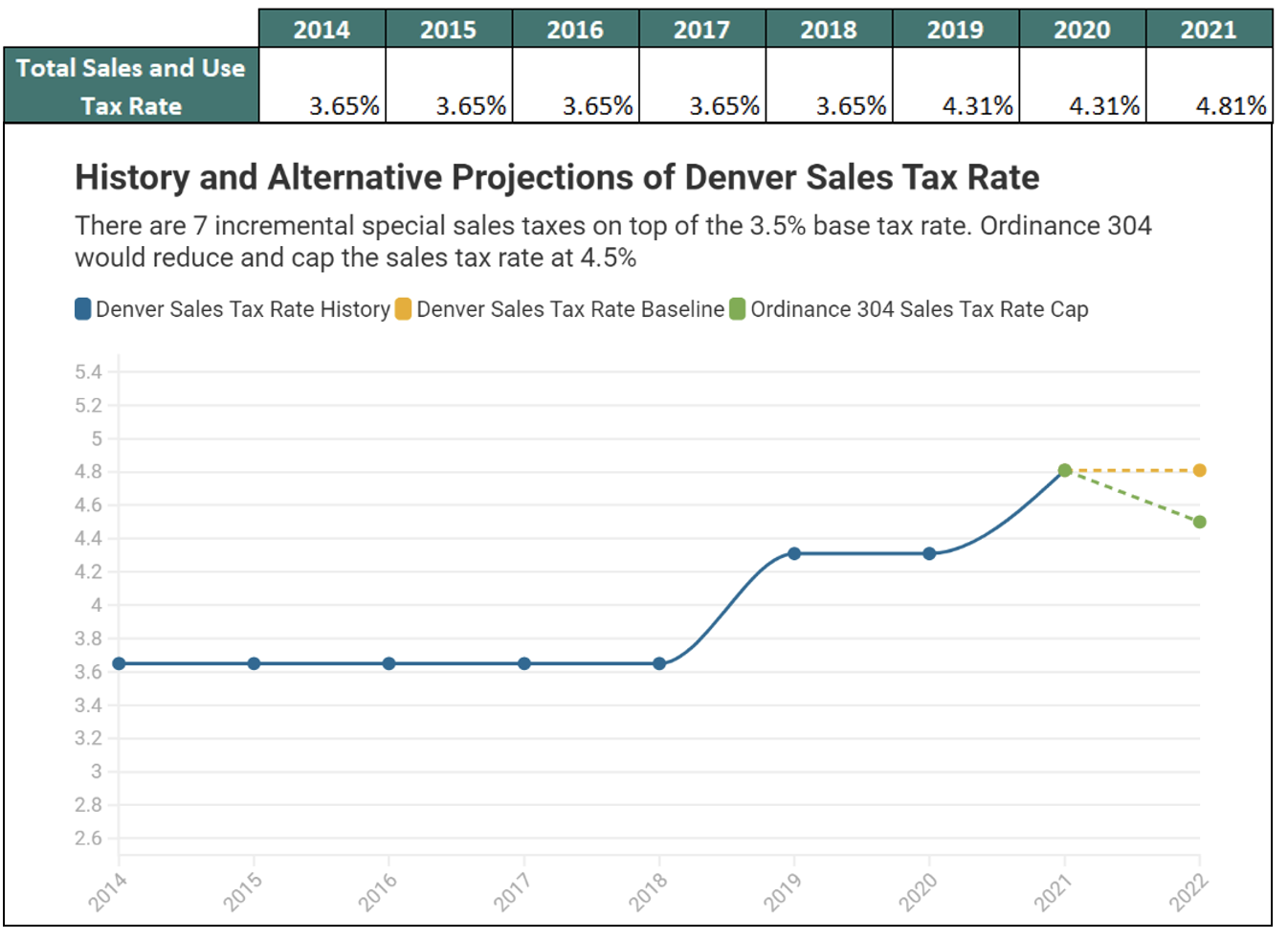

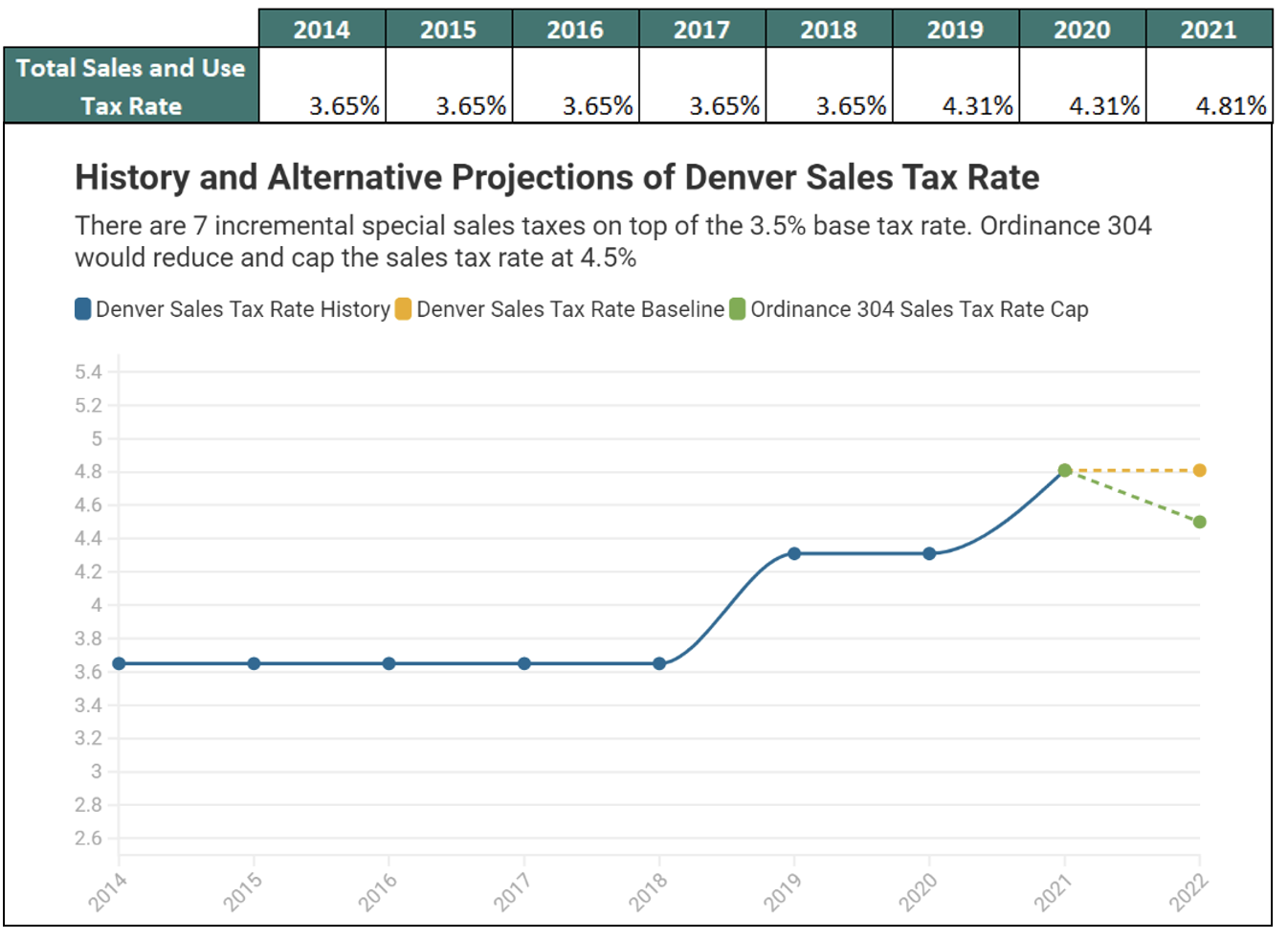

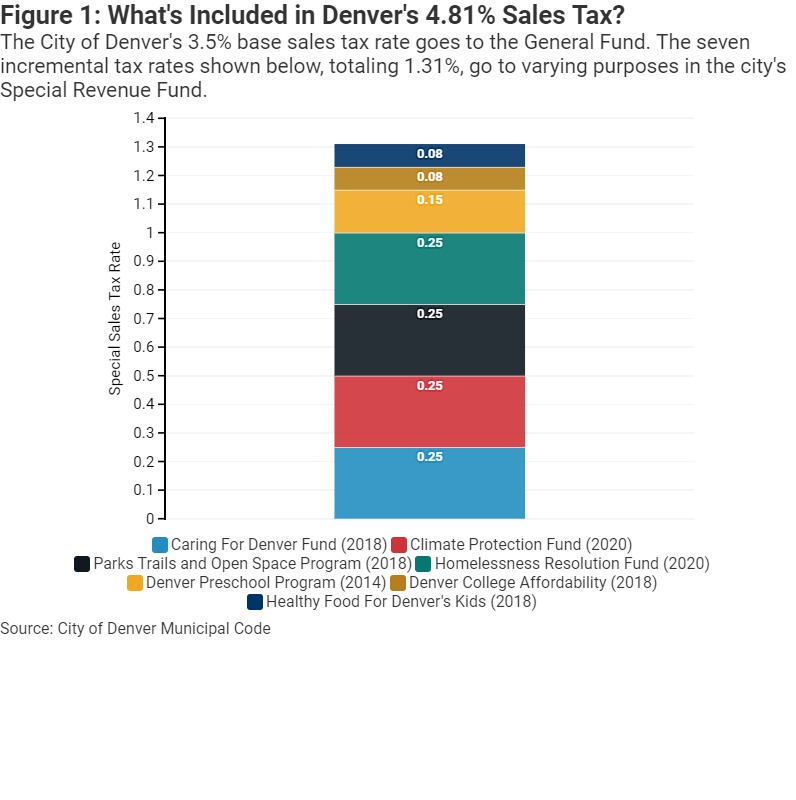

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Is Food Taxable In Colorado Taxjar

Aurora Kane County Illinois Sales Tax Rate

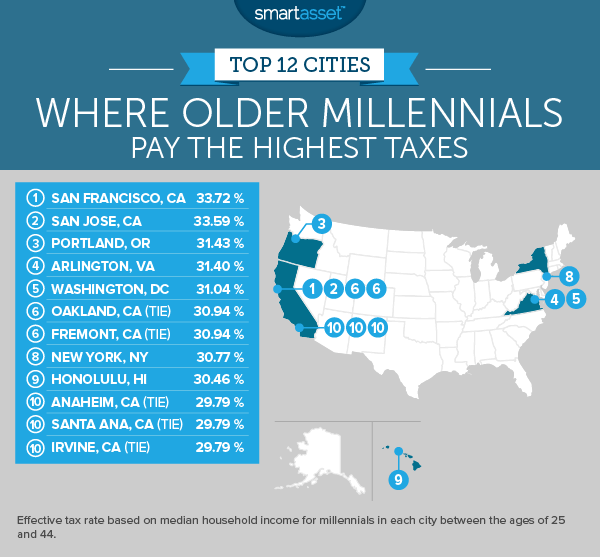

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Nebraska Sales Tax Rates By City County 2022

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Kansas Sales Tax Rates By City County 2022

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com